All Categories

Featured

Table of Contents

Insurance policy firms will not pay a minor. Rather, think about leaving the cash to an estate or depend on. For more extensive information on life insurance policy get a copy of the NAIC Life Insurance Policy Purchasers Overview.

The internal revenue service puts a limit on just how much money can enter into life insurance costs for the plan and exactly how swiftly such costs can be paid in order for the policy to keep every one of its tax benefits. If specific limits are surpassed, a MEC results. MEC policyholders may undergo taxes on distributions on an income-first basis, that is, to the degree there is gain in their policies, as well as fines on any taxable quantity if they are not age 59 1/2 or older.

Please note that outstanding financings accumulate interest. Earnings tax-free treatment likewise presumes the financing will become satisfied from income tax-free death advantage profits. Lendings and withdrawals decrease the policy's cash money value and fatality advantage, might create particular policy benefits or cyclists to end up being inaccessible and might enhance the chance the policy might lapse.

4 This is offered via a Long-term Treatment Servicessm rider, which is offered for an added fee. Furthermore, there are restrictions and constraints. A client may receive the life insurance policy, yet not the cyclist. It is paid as a velocity of the fatality advantage. A variable universal life insurance policy contract is an agreement with the primary purpose of providing a death advantage.

What is a simple explanation of Living Benefits?

These profiles are carefully managed in order to please stated investment objectives. There are fees and costs related to variable life insurance policy agreements, consisting of death and danger charges, a front-end tons, management fees, investment administration fees, abandonment charges and costs for optional riders. Equitable Financial and its affiliates do not supply lawful or tax suggestions.

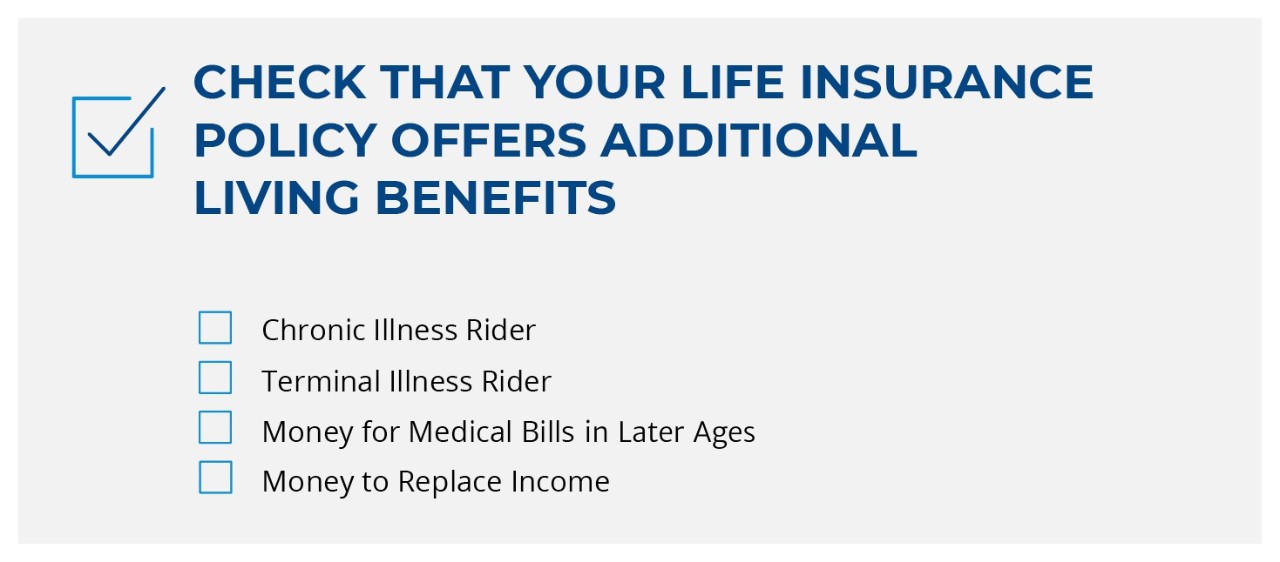

Whether you're starting a family or marrying, people usually begin to consider life insurance policy when someone else begins to depend on their capacity to gain an income. And that's terrific, since that's precisely what the fatality benefit is for. However, as you learn extra concerning life insurance policy, you're likely to discover that numerous policies as an example, entire life insurance policy have extra than just a survivor benefit.

What are the advantages of whole life insurance? Below are a few of the key things you ought to understand. One of the most appealing benefits of buying an entire life insurance policy policy is this: As long as you pay your costs, your fatality benefit will never expire. It is ensured to be paid regardless of when you pass away, whether that's tomorrow, in 5 years, 80 years or also better away. Life insurance.

Assume you don't require life insurance coverage if you do not have children? There are many advantages to having life insurance, also if you're not sustaining a household.

What is the process for getting Income Protection?

Funeral costs, burial costs and clinical costs can add up. Long-term life insurance coverage is offered in different amounts, so you can choose a fatality benefit that fulfills your demands.

Identify whether term or long-term life insurance policy is ideal for you. Get an estimate of exactly how much coverage you may require, and how much it might cost. Discover the ideal quantity for your spending plan and comfort. Discover your amount. As your personal scenarios change (i.e., marital relationship, birth of a child or job promo), so will your life insurance policy requires.

Essentially, there are two kinds of life insurance intends - either term or permanent strategies or some mix of both. Life insurers supply numerous kinds of term plans and standard life policies as well as "rate of interest delicate" products which have actually come to be more widespread given that the 1980's.

Term insurance policy gives protection for a given time period. This period might be as short as one year or supply coverage for a details variety of years such as 5, 10, 20 years or to a defined age such as 80 or in some instances as much as the oldest age in the life insurance policy death tables.

What are the benefits of Term Life Insurance?

Presently term insurance coverage prices are very affordable and among the cheapest historically experienced. It must be kept in mind that it is a commonly held belief that term insurance coverage is the least expensive pure life insurance policy protection available. One needs to assess the plan terms meticulously to determine which term life choices appropriate to meet your particular conditions.

With each new term the premium is raised. The right to renew the policy without proof of insurability is an essential advantage to you. Or else, the danger you take is that your wellness might deteriorate and you might be not able to obtain a policy at the exact same prices and even in all, leaving you and your recipients without coverage.

You must exercise this alternative during the conversion duration. The size of the conversion duration will vary depending on the sort of term policy acquired. If you convert within the prescribed duration, you are not required to give any info concerning your health and wellness. The costs rate you pay on conversion is generally based upon your "present obtained age", which is your age on the conversion date.

Under a degree term plan the face amount of the plan remains the same for the entire period. Frequently such plans are marketed as home mortgage security with the quantity of insurance policy decreasing as the balance of the home loan lowers.

What happens if I don’t have Flexible Premiums?

Typically, insurance providers have actually not deserved to transform costs after the plan is sold. Given that such policies may continue for years, insurance firms have to utilize traditional mortality, rate of interest and expense price estimates in the premium estimation. Flexible costs insurance, however, permits insurance companies to offer insurance policy at lower "present" premiums based upon less conventional presumptions with the right to alter these premiums in the future.

While term insurance coverage is made to give protection for a specified period, irreversible insurance policy is designed to give protection for your entire lifetime. To keep the premium rate level, the costs at the more youthful ages surpasses the real price of security. This additional costs builds a book (money value) which assists spend for the policy in later years as the expense of security increases above the premium.

Under some policies, costs are required to be paid for an established variety of years. Under various other plans, premiums are paid throughout the insurance policy holder's life time. The insurance provider spends the excess costs bucks This kind of policy, which is occasionally called money value life insurance policy, creates a savings element. Money worths are critical to a permanent life insurance policy.

Table of Contents

Latest Posts

Funeral Expenses Plan

Online Funeral Policy

Get Instant Life Insurance Quote

More

Latest Posts

Funeral Expenses Plan

Online Funeral Policy

Get Instant Life Insurance Quote