All Categories

Featured

Table of Contents

If you select level term life insurance policy, you can budget plan for your costs since they'll remain the same throughout your term (20-year level term life insurance). Plus, you'll recognize exactly just how much of a death benefit your beneficiaries will get if you die, as this amount won't transform either. The rates for degree term life insurance will rely on numerous variables, like your age, wellness standing, and the insurance provider you pick

Once you go through the application and clinical test, the life insurance policy business will review your application. They ought to educate you of whether you've been approved shortly after you use. Upon approval, you can pay your very first costs and authorize any pertinent paperwork to ensure you're covered. From there, you'll pay your premiums on a regular monthly or annual basis.

Aflac's term life insurance policy is hassle-free. You can pick a 10, 20, or 30 year term and appreciate the included peace of mind you are entitled to. Collaborating with a representative can aid you discover a plan that functions ideal for your demands. Discover more and get a quote today!.

This is no matter of whether the guaranteed person passes away on the day the plan begins or the day prior to the plan ends. A level term life insurance coverage policy can suit a vast array of conditions and demands.

Who offers flexible Level Term Life Insurance Quotes plans?

Your life insurance plan could additionally create part of your estate, so might be subject to Estate tax learnt more concerning life insurance policy and tax obligation. Let's take a look at some features of Life Insurance from Legal & General: Minimum age 18 Maximum age 77 (Life insurance policy), or 67 (with Important Disease Cover).

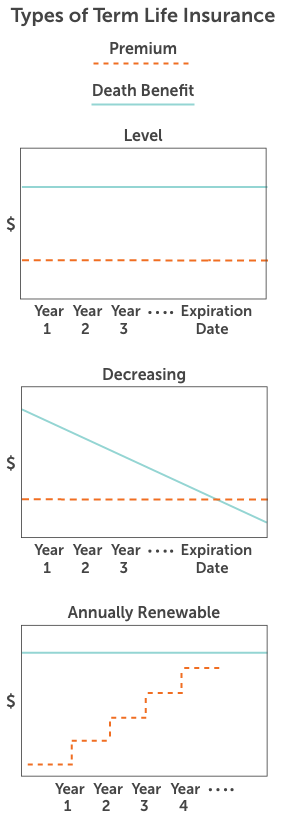

What life insurance could you take into consideration if not level term? Decreasing Life Insurance Policy can help secure a payment home mortgage. The quantity you pay remains the exact same, yet the degree of cover decreases roughly in line with the means a settlement mortgage lowers. Reducing life insurance can assist your liked ones stay in the family home and stay clear of any type of more disturbance if you were to pass away.

Term life insurance policy gives insurance coverage for a details time period, or "term" of years. If the guaranteed person passes away within the "term" of the policy and the plan is still in pressure (active), after that the death advantage is paid out to the beneficiary. This sort of insurance policy typically allows clients to originally buy even more insurance policy coverage for less money (costs) than other sort of life insurance.

What does Level Term Life Insurance Policy cover?

If any individual is depending upon your earnings or if you have obligations (financial debt, home loan, etc) that would certainly drop to somebody else to handle if you were to die, then the answer is, "Yes." Life insurance coverage serves as a substitute for earnings. Have you ever before calculated how much you'll make in your lifetime? Typically, throughout your functioning years, the solution is generally "a ton of money." The potential threat of shedding that making power profits you'll need to money your family's greatest goals like acquiring a home, paying for your youngsters' education, lowering financial obligation, conserving for retired life, and so on.

One of the main charms of term life insurance policy is that you can get even more insurance coverage for much less money. The coverage expires at the end of the plan's term. One more means term policies differ from entire life or long-term insurance coverage is that they generally do not build cash worth over time.

The theory behind lowering the payout later on in life is that the insured expects having minimized insurance coverage demands. As an example, you (ideally) will owe less on your home mortgage and other financial obligations at age 50 than you would certainly at age 30. Consequently, you might select to pay a reduced premium and lower the quantity your beneficiary would receive, since they wouldn't have as much financial obligation to pay in your place.

Why is Level Term Life Insurance important?

Our plans are designed to fill out the gaps left by SGLI and VGLI strategies. AAFMAA functions to understand and support your one-of-a-kind monetary goals at every stage of life, customizing our service to your special circumstance. online or over the phone with one of our armed forces life insurance policy experts at and find out more regarding your military and today.

Level-premium insurance is a kind of permanent or term life insurance policy where the costs stays the same over the plan's life. With this kind of insurance coverage, premiums are thus ensured to continue to be the same throughout the agreement. For an irreversible insurance coverage like whole life, the quantity of coverage offered increases with time.

Term plans are additionally usually level-premium, however the overage amount will certainly remain the very same and not grow. One of the most usual terms are 10, 15, 20, and three decades, based on the requirements of the insurance holder. Level-premium insurance policy is a sort of life insurance policy in which premiums stay the same cost throughout the term, while the amount of protection used rises.

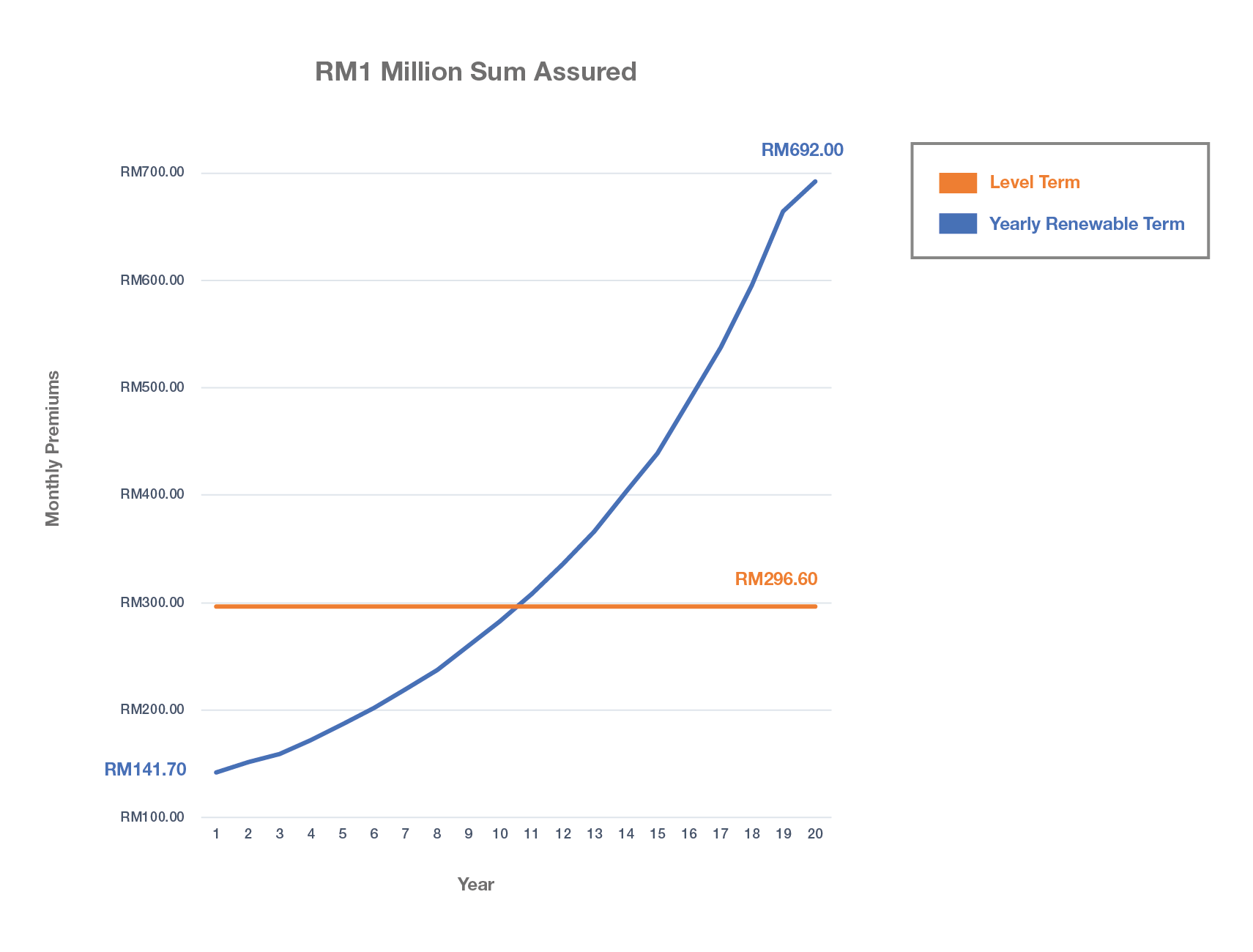

For a term policy, this indicates for the size of the term (e.g. 20 or 30 years); and for a permanent policy, up until the insured dies. Level-premium policies will normally cost even more up-front than annually-renewing life insurance policy plans with regards to only one year each time. However over the future, level-premium repayments are frequently extra cost-efficient.

How long does 30-year Level Term Life Insurance coverage last?

They each seek a 30-year term with $1 million in coverage. Jen gets an assured level-premium policy at around $42 monthly, with a 30-year perspective, for a total of $500 per year. Beth numbers she may only need a strategy for three-to-five years or till full repayment of her present financial debts.

In year 1, she pays $240 per year, 1 and about $500 by year 5. In years 2 through five, Jen remains to pay $500 each month, and Beth has actually paid an average of just $357 per year for the same $1 countless coverage. If Beth no longer requires life insurance policy at year five, she will certainly have saved a great deal of cash about what Jen paid.

Annually as Beth obtains older, she encounters ever-higher yearly premiums. Meanwhile, Jen will certainly continue to pay $500 annually. Life insurance providers are able to offer level-premium policies by essentially "over-charging" for the earlier years of the policy, collecting greater than what is needed actuarially to cover the risk of the insured dying during that early period.

1 Life Insurance Policy Statistics, Data And Sector Trends 2024. 2 Expense of insurance coverage prices are determined using methodologies that vary by firm. These prices can differ and will typically boost with age. Prices for energetic staff members may be various than those available to ended or retired workers. It's essential to check out all aspects when examining the total competition of prices and the value of life insurance protection.

How do I cancel Fixed Rate Term Life Insurance?

Like many group insurance coverage plans, insurance coverage plans offered by MetLife contain particular exclusions, exemptions, waiting durations, decreases, limitations and terms for keeping them in force. Please call your benefits manager or MetLife for expenses and complete details.

Table of Contents

Latest Posts

Funeral Expenses Plan

Online Funeral Policy

Get Instant Life Insurance Quote

More

Latest Posts

Funeral Expenses Plan

Online Funeral Policy

Get Instant Life Insurance Quote